Every year taxpayers go through the mammoth task of ITR filing. Often people are worried and have millions of doubts with one question that is always asked, “How to file my ITR?” And this question or the doubts are not only by the people filing their returns for the first time; people who have been doing this for ages also have some or other confusions.

So, what is the solution to those doubts and confusion – a handy FAQ document? This document will answer some of the most commonly asked questions at the time of ITR filing. If you also have these doubts, keep this in front of you while you file your returns.

Commonly Asked Questions Related to ITR Filing

Listed below are a few questions people tend to search online for answers. You can refer to this document and solve all your doubts concerning ITR filing instead.

Q1. Which ITR forms do I need to fill out?

It is the most common question every taxpayer may have had once while filing their returns. To answer it, the selection of the ITR form will depend on the type of your income. Let’s look at different forms:

- ITR 1 – If you are an Indian resident and earn income from salary, house property, or other sources with a total income not exceeding Rs. 50 lakhs per annum, choose this form. This form is not for individuals who have either invested in unlisted equity shares or are directors in a company.

- ITR 2 – For HUFs and individuals not in profession or business.

- ITR 3 – For HUFs and individuals in a profession or business.

- ITR 4 – For HUFs and individuals with u/s 44ADA, 44AD, and 44AE with a total income of up to Rs. 50 lakhs.

- ITR 5 – For people other than – individuals, HUF, companies, and persons filing ITR 7.

- ITR 6 – For companies barring the ones claiming exemption under section 11.

- ITR 7 – For people and companies required to furnish their returns under sections 139 (4A, 4B, 4C, 4D, 4E, or 4F).

Q2. How do I e-verify the ITR?

Once you do the ITR filing, you will have to go for e-verification of your ITR. You can refer to the below steps:

- It can be done through OTP on the number linked to your Aadhar Card.

- You can choose to generate EVC through one of the below methods:

- Net banking

- Email id and phone number

- Pre-validating your bank account

- Through the Demat account

- Or use the already existing EVC for verification.

Q3. Is there a compulsion to disclose all bank accounts?

Per the new norms, the taxpayer must disclose all savings and current bank accounts they had in the last financial year. The only exception is the non-disclosure of dormant accounts that have not been operated for the past 3 years.

Q4. How can I revise my ITR?

A taxpayer can revise their ITR under section 139(5), and it has to be done either before the expiry of the relevant year of assessment or before being processed by the department, whichever is earlier.

Q5. Is it necessary to link Aadhaar with ITR?

Yes, it is a mandate for all individuals and businesses to link their Aadhaar numbers when filing ITR.

Q6. Is it necessary to e-file the ITR, or can one do it in paper form?

Any individual or HUF whose total income exceeds Rs.5 lakhs or wants to claim a refund must e-file their ITR.

Q7. How can I upload the defective return under section 139(9)?

If a taxpayer receives an email notification regarding a defective ITR, they would need to change their original ITR and file the new ITR as per the notice under section 139(9). They would also have to insert the CPC communication number and notice date.

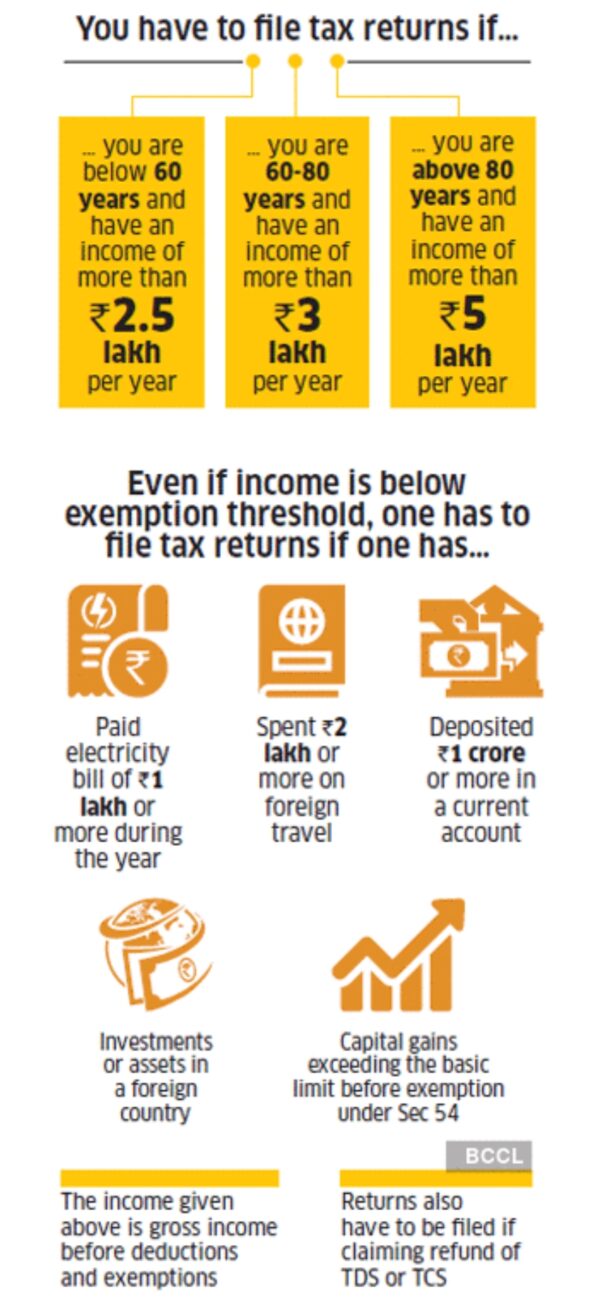

Q8. Is it mandatory to file ITR if my income is below the taxable limit?

In India, it is not always mandatory to file an Income Tax Return (ITR) if your income is below the taxable limit. However, there are certain situations where filing ITR is advisable, even if your income falls below the taxable threshold. Here’s why:

- Claiming Refunds: If you have paid taxes or have tax deducted at source (TDS) despite having income below the taxable limit, filing ITR becomes necessary to claim a refund. This is especially relevant if you have invested in tax-saving instruments or have received a refund of excess TDS.

- Establishing Financial Record: Filing ITR helps in building a financial record with the Income Tax Department. It can be beneficial when applying for loans, visas, or government schemes that require income proof.

- Carry Forward of Losses: If you have incurred losses in a particular financial year, filing ITR is essential to carry forward these losses. They can be set off against future income and potentially reduce your tax liability in subsequent years.

- Compliance and Avoiding Penalties: Filing ITR ensures compliance with tax laws, preventing any potential penalties or legal consequences in the future.

Q9. Can I file ITR online? What are the steps involved?

Yes, you can conveniently file your Income Tax Return (ITR) online in India. The process has been simplified through the Income Tax Department’s e-filing portal. Here are the steps involved:

- Registration: Visit the e-filing portal (incometaxindiaefiling.gov.in) and register yourself as a taxpayer. Provide your PAN (Permanent Account Number), basic details, and create a user ID and password.

- Choose the Appropriate ITR Form: Select the correct ITR form based on your income sources, such as ITR 1 (Sahaj) for salaried individuals, ITR 2 for individuals with capital gains, or ITR 3 for business or profession income. Download the form and save it on your computer.

- Fill in the Details: Open the downloaded ITR form and fill in the required details, such as personal information, income details, deductions, and tax payments. Ensure accuracy and cross-check the information before proceeding.

- Validate and Generate XML: Validate the filled-in ITR form to ensure correctness and generate an XML file.

- Upload and Submit: Log in to your e-filing account, navigate to “Filing” and select the appropriate assessment year and ITR form. Upload the generated XML file and submit it.

- Verify ITR: After submitting, verify your ITR using any of the available methods such as Aadhaar OTP, EVC (Electronic Verification Code), or by sending a signed physical copy to the Centralized Processing Center (CPC) within 120 days.

Remember to keep a copy of the filed ITR and the acknowledgment receipt for future reference. In case of any doubts or complexities, consult a tax professional or use the assistance available on the e-filing portal.

Wrapping up Thoughts

ITR filing is mandatory for everyone and should be done carefully to avoid errors. It can be daunting to redo the work again if it’s not correct the first time. In case you feel you need help, contact a CA for ITR purposes. They are experts and know the in and out of ITR filing. So, their help will save time and ensure you have submitted the correct ITR.