There’s no quick way to improve net worth, but with patience and a sound strategy just about anyone can achieve a measurable amount of success. One reason it’s so hard to write a formula for enhancement is that everyone’s situation is completely unique. We all have different asset and liability profiles, job skills, investing acumen, living situations, and spending habits. With all those unique aspects in mind, however, it is possible to craft a template for boosting net worth that works for the vast majority of working adults.

So, unless you’re an extreme case, either on the verge of bankruptcy or already there, the following techniques can help bring your net worth figure where you want it to be.

Dig for Every Asset

Digging for assets means getting creative about exploring every single thing you own that has any value at all. Everyone is familiar with the old trick of combing through the garage, attic, basement, storage units, and spare bedrooms for garage sale items. That’s actually an ideal starting point for this effort because not only can you make a detailed inventory of everything you possess, but you can also pluck out those for sale pieces and turn them into cash via a yard, garage, or online sale. It’s an effective way of literally pulling cash out of your stored stuff.

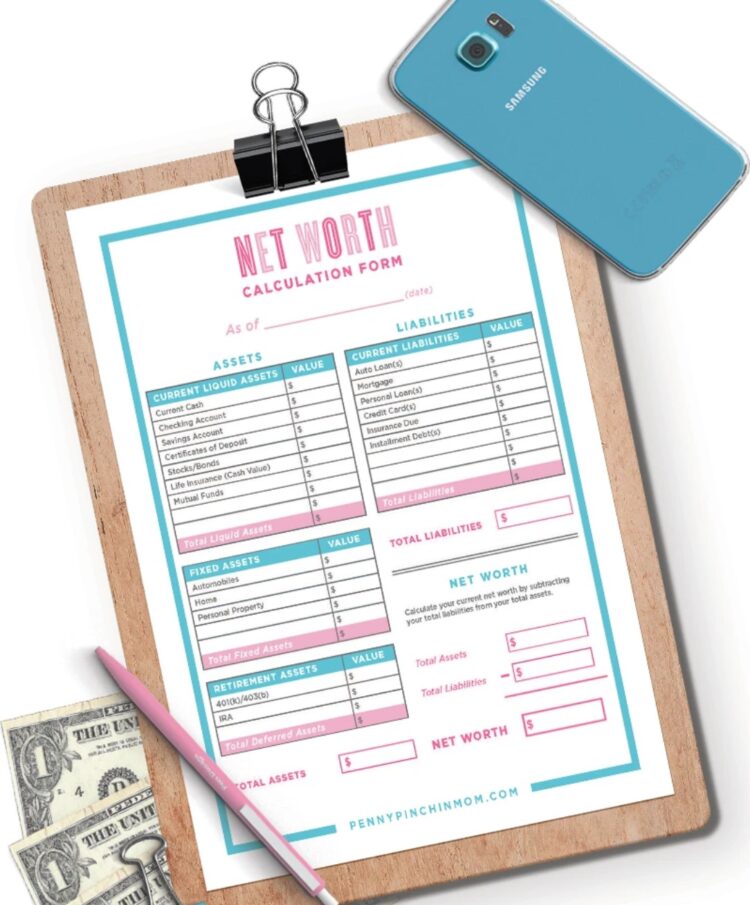

But digging for assets means going one step further. Remember the inventory sheet you filled out while scouring for saleable goods? Now is the time to scratch off everything you sold and examine the leftovers. Some of the low-cost things that have no chance of ever selling anywhere should be given to charity if you don’t want to keep them. But, be careful about larger or more precious assets that have actual value but that you don’t want to sell or give away. They are excellent candidates for including in your net worth calculation. And because they are assets, the plus side of the equation will rise by including them. Used cars, gun collections, coins, family heirlooms, fine art, furs, jewelry, machinery, collectible rugs, and hundreds of other things that you can put a fair price tag on are candidates for net worth boosters.

Refinance When Possible

Review your entire range of debt, from credit cards to mortgages. Carefully analyze interest rates, terms, and amounts owed. If there are a few smaller cards or debts you can pay off immediately or very soon, do so. For larger accounts, look into refinancing. This strategy works well with vehicle loans, education debt, and mortgages, the three easiest kinds of debt to refinance. Never do a refi unless you can be sure of reducing interest rates. The whole point of the process is to eliminate interest and pay off principal balances as quickly as possible.

For most people, the first part of this technique is to switch out high-interest plastic for lower-interest cards. Then check with reputable lenders who do vehicle refinancing to see if you can snag a better deal on the car loan. Finally, if you already have some equity built up in your home, a refi can be a powerful, and quick, way to chop a significant amount of interest from your life.

Invest Wisely

Investing can be a neutral, negative, or positive factor in the scheme of things. The whole point of investing is to earn a profit, but the question is how best to do that. Many working people robotically park money in brokerage accounts, seldom create pro-active trading strategies, and end up earning tiny amounts of interest, or none at all, on their holdings.

Instead, consider a couple of techniques from Warrior Trading for ramping up returns on your hard-earned cash. Penny stocks, for instance, represent a financial vehicle that has high potential returns. Consider what happens if you acquire one share of a stock that costs $250. To earn a five percent profit, ignoring fees and taxes, the price needs to move up by $12.50. But if your penny stock cost you $4, a one-dollar rise in price represents a 25 percent return. This mathematical anomaly is why many traders prefer to own low-cap, or penny securities.

Pennies come with a bit more risk because the companies that issue them tend to be smaller and newer. There’s a way to minimize risk, which means eliminating the sole downside of small-caps. Be diligent in your research, honing in on small-cap corporations that have stable management teams, have been around for more than a decade, and whose share prices have been relatively steady. Some of the best startups and smaller tech firms, for example, are prime candidates for this style of investing.

Consider Getting a Second Job

Taking on another job can be a blessing or a curse, depending on multiple factors. For starters, don’t aim to add part-time (20 hours per week) work to your schedule unless you can easily take on the added commitment. But don’t feel bad if you decide against a part-time job, because there are alternatives. Consider a side hustle that eats up no more than 10 hours per week, and strive for online employment.

Working online means no additional driving, not having to dress for an office environment, and flexible schedules. The really good news is that an extra 10 hours per week can bring in 500 hours of pay on top of what you already earn each year. At $15 per hour, you’re looking at $7,500 for your efforts. Micro gigs are one of the simplest, most reliable ways to put money in the bank and up your personal wealth factor.

Eliminate Expenses

Spend several hours analyzing your monthly budget and find at least one expense category that you can pare down. For the majority of working people, entertainment, fast food, eating out, and impulse buying at convenience stores are common culprits. Another is buying lunch on work days instead of bringing a brown bag from home. Even a simple switch to brown bagging can save you well more than $1,000 per year. There’s no need to be extreme, so consider allowing yourself a few non-bag lunches with work friends a couple times per month.