Embarking on the journey of becoming a retail trader can be exhilarating yet daunting. The world of trading offers vast opportunities for personal and financial growth, but it also requires a solid foundation, discipline, and continuous learning. In this article, we will explore the essential steps and strategies to guide you through starting your trading journey, ensuring you are well-equipped to navigate the markets.

Understanding Retail Trading

Before diving into the specifics of becoming a trader, it’s crucial to understand what retail trading entails. Retail traders are individuals who trade financial instruments such as stocks, bonds, currencies, and commodities in the financial markets, using their capital. Unlike institutional traders, who trade on behalf of financial or investment companies, retail traders are private individuals, often exchanging from home or a personal office.

In this evolving market landscape, platforms like Invesus have become increasingly popular, providing retail traders with the tools and resources they need to make informed decisions. These platforms offer a wide range of services, including market analysis, trading signals, educational resources, and user-friendly exchanging interfaces, which are essential for those looking to navigate the complexities of the financial markets successfully.

Establishing Your Trading Foundation

The first step in your trading journey is to build a strong foundation. This involves gaining a thorough understanding of the financial markets and the various instruments you can trade. It’s essential to familiarize yourself with market terminology, platforms, and the mechanics of how trades are executed.

Education and Research

Start with a commitment to education. There are numerous resources available for aspiring traders, including books, online courses, webinars, and forums. Focus on resources that cover the basics of exchanging, technical and fundamental analysis, and risk management. It’s also beneficial to follow market news and analysis to understand how global events affect financial markets.

Choosing a Trading Style

Trading styles vary widely among retail traders, and choosing one that suits your personality, lifestyle, and financial goals is important. The most common styles include day, swing, position exchanging, and scalping. Each style has its time frame, risk profile, and strategies. Experiment with different styles in a simulated trading environment to find what works best for you.

Risk Management

One of the most critical aspects of trading is risk management. It involves understanding and managing the potential losses associated with exchange. Effective risk management strategies include setting stop-loss orders, only risking a small percentage of your capital on a single trade, and diversifying your trades to spread risk.

Setting Up Your Trading Infrastructure

With a solid foundation in place, the next step is setting up your exchange infrastructure. This involves choosing a broker, setting up a trading account, and familiarizing yourself with a platform.

Choosing a Broker

Your broker is your gateway to the markets, so choosing a reliable one that fits your trading needs is crucial. Consider factors such as regulation, fees and commissions, the range of available exchanging instruments, and the quality of customer support. It’s also wise to read reviews and compare several brokers before making a decision.

Trading Platforms

Most brokers offer their proprietary trading platforms or support popular third-party platforms. A good exchanging platform should be user-friendly, offer robust charting and analytical tools, and provide stable and fast execution of trades. Spend time getting to know the platform you choose, as proficiency with your exchanging platform is crucial for effective trading.

Developing Your Trading Strategy

A exchanging strategy is a set of rules and criteria that guide your trading decisions. Developing a robust exchange strategy involves identifying potential trade setups, entry and exit points, and money management rules.

Technical and Fundamental Analysis

Most trading strategies are based on technical analysis, fundamental analysis, or a combination of both. Technical analysis involves studying price charts and using technical indicators to predict future price movements. Fundamental analysis, on the other hand, involves analyzing economic indicators, company financials, and news events to gauge the market’s direction. Understanding both approaches allows you to make more informed trading decisions.

Backtesting and Paper Trading

Before risking real money, it’s important to test your exchange strategy through backtesting and paper exchange. Backtesting involves testing your strategy against historical data to see how it would have performed in the past. Paper or simulated exchanging, allows you to practice trading in real-time without risking actual capital. Both methods provide valuable insights into the effectiveness of your strategy and help you make necessary adjustments.

Staying Disciplined and Continuously Learning

The final, and perhaps most challenging, aspect of becoming a successful retail trader is maintaining discipline and a commitment to continuous learning.

Emotional Control

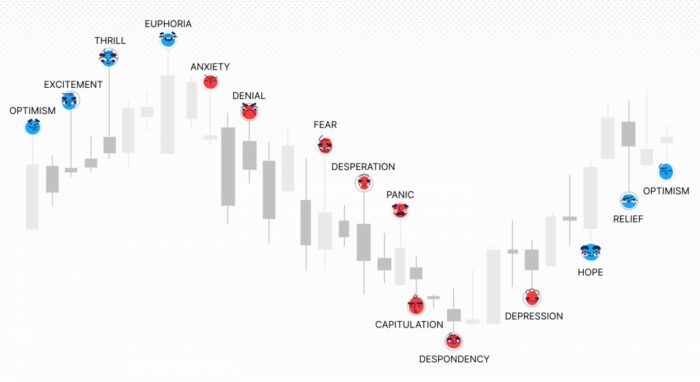

Trading can be an emotional rollercoaster, and maintaining control over your emotions is essential for success. Fear, greed, and frustration can lead to impulsive decisions and significant losses. Developing a disciplined exchange routine, sticking to your trading plan, and taking breaks when needed can help manage your emotions.

Continuous Learning

The financial markets are constantly evolving, and successful traders never stop learning. Stay updated on market trends, new trading tools and strategies, and global economic events. Joining exchanging communities and engaging with other traders can also provide valuable insights and support.

Dealing with Losses

Losses are an inevitable part of trading, and how you deal with them can significantly impact your success. View losses as learning opportunities and analyze what went wrong to improve your future trades. It’s important to have a healthy attitude towards losses to maintain your confidence and motivation.

Conclusion

Becoming a retail trader is a journey that requires dedication, discipline, and a continuous desire to learn and improve. By building a strong foundation, setting up your exchanging infrastructure, developing and testing your exchanging strategy, and staying disciplined, you can increase your chances of success in the trading world. Remember, trading involves significant risk, and it’s important to approach it with caution and respect for the markets. With the right mindset and approach, exchanging can be a rewarding endeavor both personally and financially.