There is absolutely no doubt that tax season can be overwhelming. No one enjoys filing their own taxes, but still, it is something that has to be done. The truth is that a third of Americans do this on their own.

There are numerous documents you need to have at your disposal to complete this task, and W-2 is an essential one. It contains all the information you need, and your employers are required by the law to send this document to you. But what happens if you didn’t receive the W-2 form?

Can you file tax with a pay stub?

The answer to this question is yes. You can file your tax even if you don’t have the W-2. All you need is your last pay stub. This document contains all the information you need, and you can generate it by using an online tool such as paystubsnow.com. It will enable you to understand how much you own, and as long as you are using the e-filing system, that is, as long as you are completing this task online, it is relatively simple.

What are the requirements?

There are a few steps you have to take, and the first one is notifying the IRS that you will file your taxes online. Then, you will have to fill out the 4852 form. However, keep in mind that there are certain requirements you have to meet in order to be able to do this online. Firstly, according to the IRS, your maximum gross income cannot surpass $57,000. If your income exceeds this number, you won’t be able to do this online but, instead, you will have to mail the tax return. Secondly, you cannot use the e-filing system if you are under 16 years of age and have never done this in-person before.

What is the 4852 form?

As already mentioned, this document enables you to file your taxes using a pay stub if you don’t have the W-2 form at your disposal or you received one with incorrect information. No, it won’t help you get your refunds faster, but it is instead simply an alternative option. Due to this reason, you will have to clarify why you are using it instead of the W-2. You have to explain that you weren’t able to obtain the W-2 for your employer or the financial institution, and finally, you have to state that you have informed the IRS about your problem. Easiest way is to get payslips online and file your taxes.

Fill out the form

Now that you have concluded the initial steps, it is time to fill out the 4852 document. As already said, all the information you need will be on the pay stub, so you should begin by writing your name, address, and your employer’s Tax ID number at the bottom half of the document. Then, you can proceed by going over all the additional information such as wages, tips, and other forms of compensation, social security wages and tips, medicare wages and tips, federal and state income tax withheld, and so on.

You pay stub includes all the deduction listed as abbreviations, and you will need these to calculate the annual tax payment. If the pay stub includes your monthly income, all you have to do is add all the deductions together and multiply them by 12. On the other hand, if it includes a bi-weekly income, do the same thing just multiply them by 24.

Furthermore, remember that the top half of the form is filled out by people who get their W-2 form, while the bottom section is intended for those that get the 1099-R. It means that you shouldn’t fill out this section.

Use a tax calculator

We cannot stress enough how important this is. It is the only way to ensure that you have got the right number, and you won’t be paying too much or too little. There are numerous online tools that you can use, but you have to make sure that it is updated to the current tax year. You should run these numbers several times through the calculator to be certain that the final result is accurate. If you notice any issues, meaning that IRS owns you a refund, or on the other hand, that you are the one who owns a lot of money, you will have to do research and make necessary changes.

Moreover, make sure to include any additional information in the calculation. For example, you may have a dependent. If this is the case, it is crucial to feed this information to the tax calculator.

Certify your information

Finally, upon doing all the calculations and filling out the form, you will have to clarify how you reached the amount stated. A simple sentence that explains this will suffice. Once again, don’t forget to include additional explanations why you are using this form instead of the W-2 one. You should write down all the details on how you tried to obtain it but were unsuccessful due to numerous factors (explain these as well). Finally, you have to print out the 4852 form and sign it because otherwise, it won’t be accepted by the IRS.

Potential issue

A lot of people want to be done with their taxes as soon as possible, but this is not possible since the IRS doesn’t process funds until the end of January. Due to this reason, as already mentioned, using the 4852 document for the purpose of accelerating the process will not work.

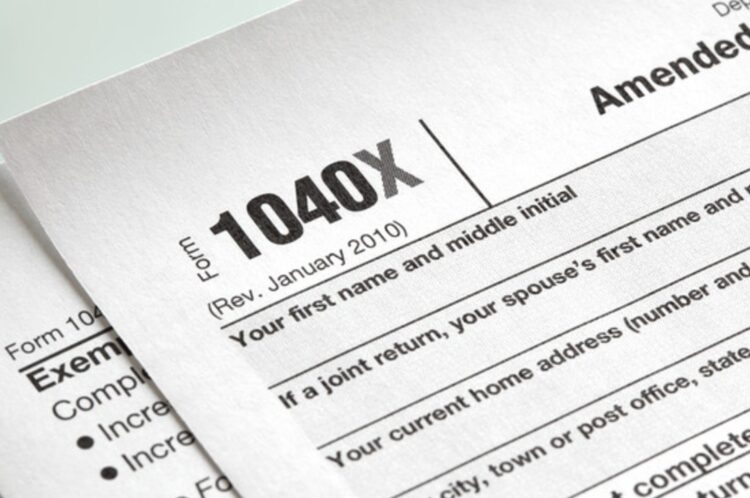

Furthermore, if you file taxes with this form and the pay stub and later receive all the tax documents with a different amount than the one you originally calculated, you will have to file an amended tax return with the 1040X form.

Wrapping up

Even though many people dread the tax season, as you can see, it doesn’t need to be so bad. Yes, you will have to invest some time and effort into gathering all the information, but even if you don’t have the W-2 form, you can still file your taxes without any issues.