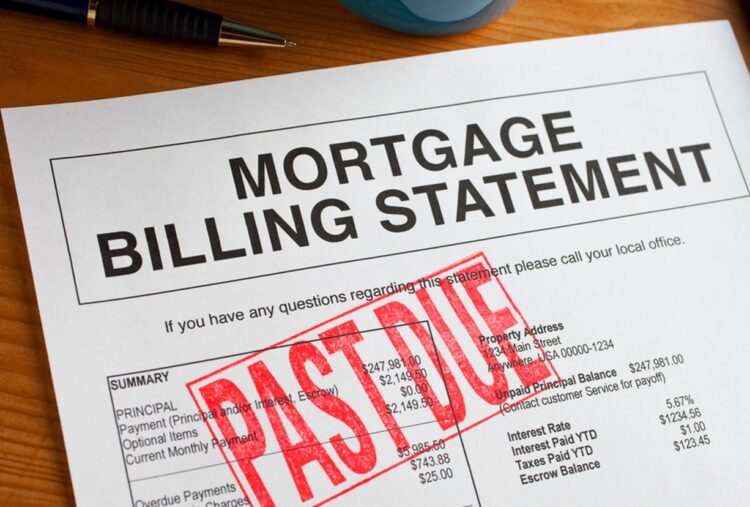

Owning a home is very nice, but only if you really can afford it and if you are able to continuously settle your credit obligations. Otherwise, if you can’t pay off your house mortgage, the foreclosure will follow – your lender has the full right to seize your home because you didn’t pay your obligations on time. Also, if the value of the house is not enough, you may find yourself in a position to owe the lender extra money. In addition to the fact that this is very stressful and difficult to resolve the situation, foreclosure can have a negative impact on your future and prevent you from qualifying for a loan again. And all of this is why you want to avoid it at all costs. If you’re interested in this topic keep reading, because we’ll discuss ways to avoid a foreclosure on your house:

1. Don’t run away from problems

While this sounds like very logical advice, you would be surprised how many people are willing to ignore the problem indefinitely, until they end up in a hopeless situation, which in this case means facing foreclosure and losing property. Before you get into this position, do everything in your power to avoid this final event. How? By realizing in time that you are having difficulty repaying the loan and that you need to do something about it as soon as possible.

Remember: You should not be ashamed if you cannot settle your obligations on time. There is a solution to everything and the sooner you realize that you are facing a challenge, the sooner you will try to do something about it and get back on track. If you cut the problem at the root, you probably won’t have to deal with the bigger one.

2. Organize your documents

Once you notice that you are late with your mortgage payments, it is necessary to organize yourself adequately. That means collecting all the documents and putting them in one place. These documents may include a copy of the mortgage and bill of exchange, any documents you hold of your monthly income, statements of payments you have made so far, as well as information about insurance, property taxes, and any other document relevant in this situation.

This is the first important step before you take further steps to prevent foreclosure. Once you organize all the documents and files you will have more clarity, you will feel like you have taken control into your own hands and you will be able to make better decisions.

3. Get familiar with your mortgage rights

Once you have collected and organized all the documents, it is time to read them and get acquainted with your mortgage rights. Knowledge is power and that is why it is important not to be ignorant because in that case, you will not know how to react and what your rights are in this situation where you are late with loan repayments. If you need help, you can always hire a lawyer who will inform you more about your rights and possibilities.

Learn more about foreclosure laws, as well as what deadlines the law provides for in this situation. Each country has different rules, so it is necessary to find out about your own. In most cases, only after you have not settled your obligations within 4 months, the lender can start the foreclosure process. Get informed, because only then you can really do something about the situation you are in.

4. Consider selling your house

If time passes and you still fail to reduce your mortgage debts and foreclosure is getting closer, we suggest you consider selling your home. We know that this is a very difficult decision, but if you are in a hopeless situation, then this may be the only and best choice. Of course, you must first check that you meet the requirements for this alternative. In some situations, it is possible to sell the house to avoid foreclosure, but it is necessary to do so within a certain, legally prescribed, time frame.

When you are in a hurry to sell a house, you will agree that selling through a real estate agent is not the best option, because it can take time, and that means that you may even lose the opportunity to avoid foreclosure. In these situations, we suggest that you consider direct sales, without the mediation of an agent. At sellyourgainesvillehometoday.com you can learn how to sell your house in the fastest and easiest way, no matter what condition it is in. You do not have to make any repairs, cleaning, or invest extra money. You will receive an offer as soon as possible and decide whether to go with it.

Note: If foreclosure is unquestionable, selling a home may be the best move you can make.

5. Don’t hesitate to ask for help

Many people feel ashamed when they miss out on a loan installment or when they know it could happen. While it really is a frightening thought that you can lose property, there is so much you can do to keep it from happening. Don’t hesitate to ask for help. It’s always a good idea to call your servicer as soon as you realize you’re late with your payment and inquire about your options. No one wants to start the foreclosure of your home, but it only happens when there is no other option. If you make an effort to solve the problem, it is likely that there will be no foreclosure at all.

Conclusion: Owning a home is a really nice thing if you are able to finance it and continuously repay your mortgage. If this is not the case, and you are several months late with payments, your lender can start the foreclosure process. However, even if you have financial difficulties, you can avoid foreclosure by taking some smart steps.

For starters, the most important thing is not to ignore the problem, but to detect it, accept it, and start working on solving it. Collect all important documents, read them thoroughly and make sure you understand your rights. Only if you are completely sure that enforcement is inevitable can you start thinking about selling your house to get out of trouble. Everything is solvable, you just need to take control and not give up until you come to a solution that you are satisfied with.